- This event has passed.

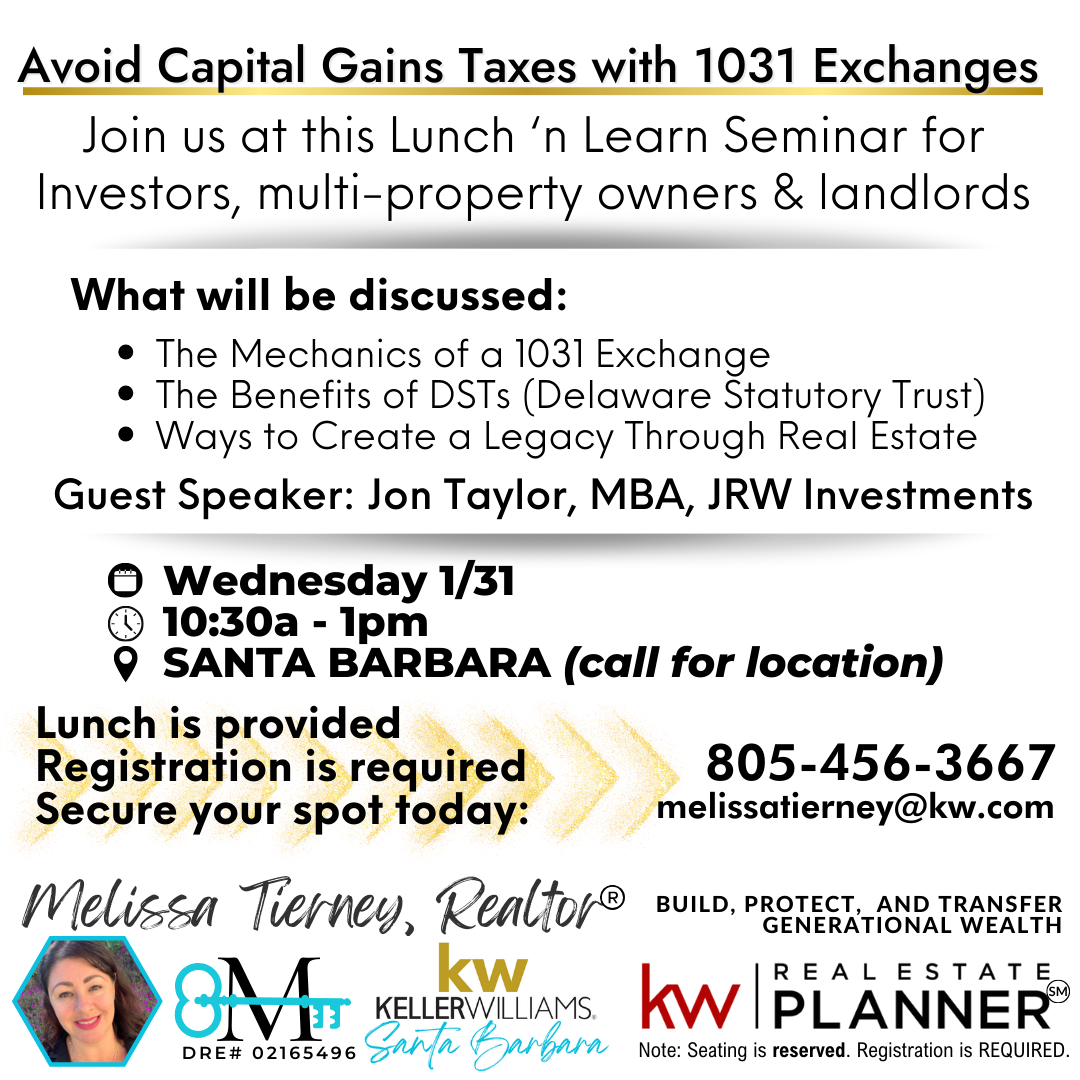

The Hidden Potentials of 1031 Exchanges | A Seminar for Landlords, Multi-property Owners & Investors

January 31, 2024 @ 10:30 am - 1:00 pm PST

Investors, Multi-property owners & Landlords: this is a seminar you do NOT want to miss!

Come to this Lunch ‘n Learn seminar on 1031 exchanges, where we will talk about the advantages of Real Estate Planning, how to avoid capital gains taxes, and the advantages of DSTs.

Real Estate Planner & 1031 certified, Melissa Tierney will speak on the advantages of a Real Estate Plan and how to avoid paying capital gains taxes.

Guest Speaker Jon Taylor, MBA at JRW Investments will be speaking on the mechanics of DSTs and how to grow legacy wealth through Real Estate.